Film & Entertainment

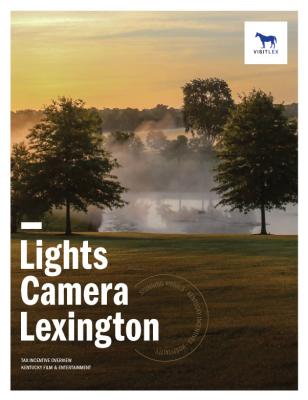

LIGHTS. CAMERA. LEXINGTON.

Lexington, Kentucky is ready for the spotlight. With stunning locations, a generous 30-35% fully refundable tax credit incentive, and our award-winning hospitality team on your side, bringing productions of all sizes to life in the cinematic beauty of Central Kentucky’s Bluegrass Region has never made more sense.

BEST-IN-CLASS INCENTIVES

The Kentucky Entertainment Incentive (KEI) Program is an industry-leading initiative that ensures your budget goes toward realizing your vision, not location expenses. We want you to put your money back into your artistic endeavor! Highlights include…

- 30–35% fully refundable tax credit

- Up to $10 million per project

- Up to $75 million per year

KEI Program details, including a full list of qualifying expenditures, can be found HERE.

BEST-IN-CLASS SERVICE

Lexington’s front porch hospitality is unmatched. Our dedicated team will create a concierge-level production plan based on the needs of your project. Looking for some local perspective? We’ll connect you with Lexington’s growing artistic and film communities for an additional source of expertise.

ABOUT LEXINGTON

Old and new, traditional and progressive—in Lexington you’ll find the best representations of the Bluegrass State’s most iconic assets in a setting that captures the essence of the American South and much of the Midwest like nowhere else.

Diverse Landscapes

Lexington is a bustling modern city surrounded by quaint small towns frozen in time. Rolling bluegrass hills, lush forests, mountains, rivers, or Main Street—wherever your scene, you can find a spot to shoot it in Lexington.

Historic Architecture

Lexington’s rich past is evident in many well-preserved structures—including idyllic horse stables and authentic bourbon rickhouses—that evoke feelings of nostalgia and represent unique eras of American history.

Easy Accessibility

About an hour from Louisville and Cincinnati, Lexington’s location at the intersection of I-64 and I-75 puts it within a day’s drive of ⅔ of the US population, and Blue Grass Airport offers direct flights to 15 major cities.

Not to mention…

- #34 US News and World Report’s Best Places to Live 2023-2024

- Lexington leads in LGBTQ Inclusivity, based on the Human Rights Council’s Municipal Equality Index

More Lexington facts and figures, including tips for visitors, can be found HERE.

Learn more about Lexington and the generous incentive program here:

CONTACT US

VisitLEX wants to help make your next production a huge success! Please feel free to reach out to the dedicated team member with any questions.